|

| Don't you hate it when you lose your wallet and it has R300k in it? |

My total investment balance:

End January 2020 – R1,577,324

End March 2020 – R1,280,113

The value of my investments went from the highest they have ever been back to where I was in January last year. Ouch!

Updating my monthly investment and FIRE tracker was a pretty morbid affair.

Pension funds – smack!

TFSA – smack!

Discretionary investments – smack!

Share matching account – smack!

R300k down in two months.

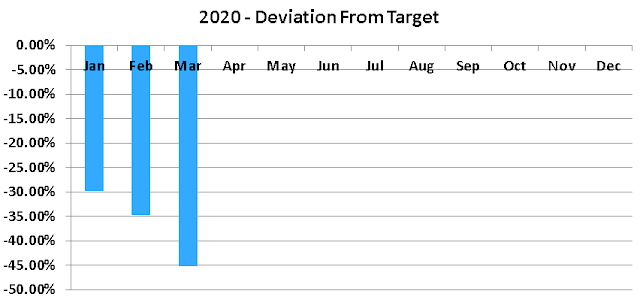

Sometimes a picture can be worth 300,000 words, so below is a chart showing how my investments.

Looks like the Timmy (the blue worm) is heading underground!

And if you translate this into my aspirations for financial freedom by 2030, it gets even nastier.

At close to 50% off target, it means I now have only around half of what I should.

Right, time to throw in the towel. This investing thing clearly doesn’t work. Financial freedom is a total pipe dream.

No, no no!

Despite everything that has happened, all hope is not lost.

The reason I showed you these charts and painted a such a doom and gloom picture, is to make you realise that you are not alone. Pretty much anyone who has any sort of investment has taken strain. It’s pretty normal to be feeling stressed, overwhelmed and a little helpless. The natural human behaviour is to want to do something.

But the best thing you can do is nothing!

Don’t change anything – stick to your investment plan and keep buying what you would have bought

For those of you still in the asset accumulation phase of their investing, the market is presenting us with a fantastic opportunity to pick up some great long term investments at some ridiculously cheap prices. What a time to be alive!Today is the 1st, which means I buy the same ETFs I always buy.— Stealthy Wealth (@stealthy_wealth) April 1, 2020

The market being down just means I get the exact same ETFs at a much better price.

Buying when prices are as beaten down as they are now might go against every gut feeling you have, but I believe that it is absolutely the best thing you can do!

Why?

Well, let me just repeat this picture I put in the previous blog post

As you can see, the money that you invest now is in the running for some stellar returns over the next few years.

People, this is absolutely not the end of the world.

The corona virus will run it’s course, and life will go on. Companies will recover, and their share prices will rise. In the not too distant future we will be looking back at all of this and thinking what a great long term buying opportunity this was.

I am excited to be getting some money in at these low levels, and if the markets drop even further, it means that next month I will get my ETFs at even cheaper prices. I then look forward to making up the large deficit in my FIRE plan

Opportunities like we have now don’t come around often, so try make full use of it. Do whatever it is you need to do to keep buying and stick to your investment plan – even if that means closing your eyes when clicking the buy button!

Till next time, Stay Stealthy!

- ~ - ~

If you enjoyed this post, it has been scientifically proven that you have a 96.78% chance of liking future posts.

Don’t argue with statistics, sign up to the mailing list and get the newest stuff delivered to your inbox!

Don’t argue with statistics, sign up to the mailing list and get the newest stuff delivered to your inbox!